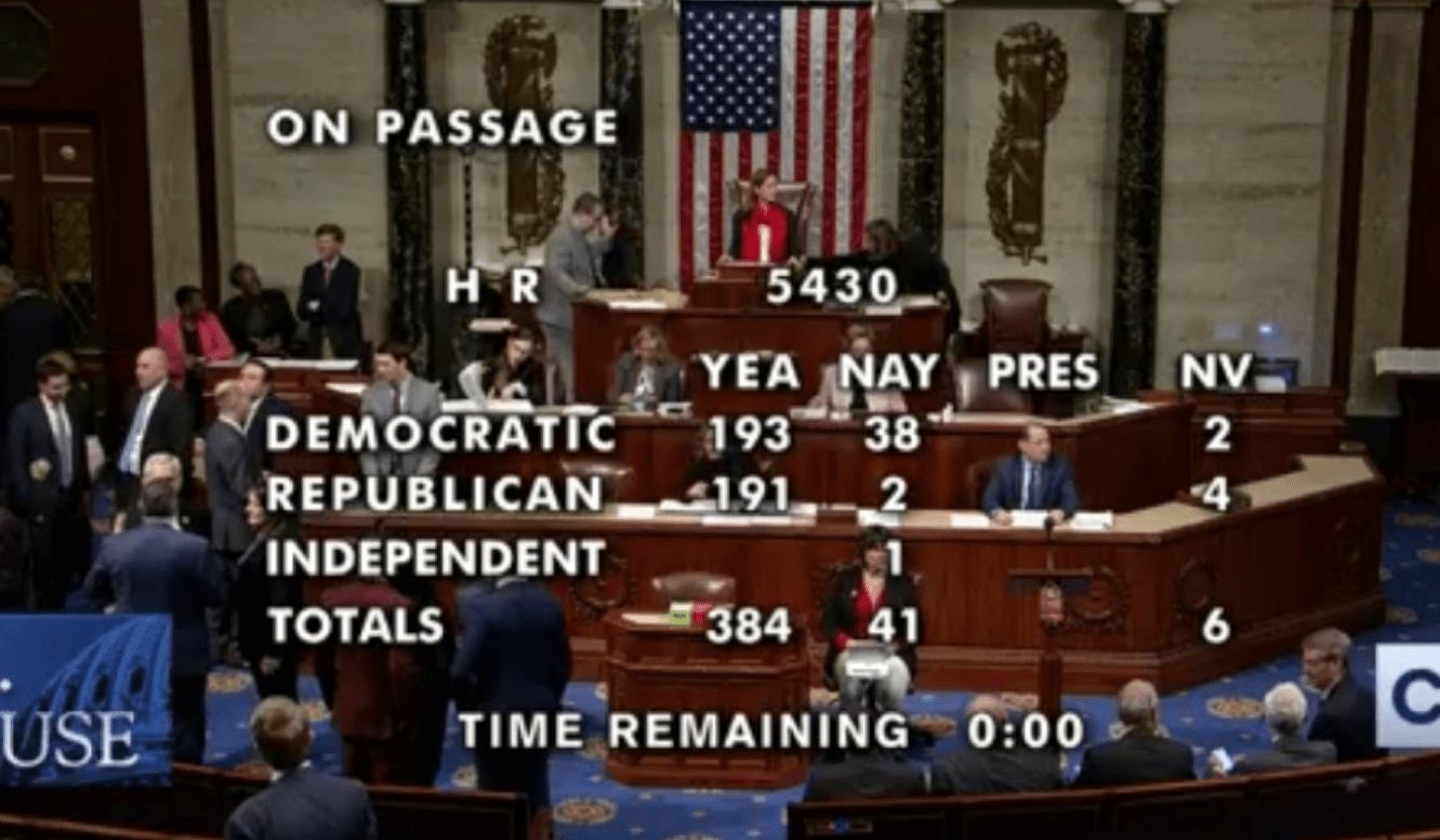

WASHINGTON D.C. (NBC News) – Last week, President Donald Trump signed a $2.2 trillion economic rescue package, calling the bill much-needed relief for American workers reeling from the economic tumult caused by the coronavirus.

NBC News reached out to the federal government with questions about who qualifies, how much Americans will receive, and who is ineligible, and received the following answers.

How much will I get?

This depends on how much you make. If you have already filed your 2019 tax return, the checks will be automatically based on that. If you haven’t filed for 2019, it will be based on your 2018 return.

You will be eligible for the full payment of $1,200 if you made less than $75,000 in 2019. Couples will receive $2,400 if they filed jointly and made less than $150,000. If you filed as “head of household,” and earned $112,500 or less, you’ll receive $1,200.

You will receive an additional $500 for every child in the household.

Your payment will be reduced by $5 for every $100 of income that exceeds the limits if you made more than $75,000.

For example, if in 2019 you made $80,000, you will receive $950.

NBC News report the payment “decreases to zero for an individual making $99,000 or more or a couple making $198,000 or more.”

A family of four will be eligible for a maximum of $3,400.

When will I receive the money?

On March 25, Treasury Secretary Steven Mnuchin said if the IRS has your information, the checks would be sent out “within three weeks.”

If you have been working and paying taxes since 2018, you do not need to sign up or fill out a form to receive a payment, NBC News reports.

A “public awareness campaign” will also be put on by the Treasury Department which will have information for those who did not file a tax return for 2018 or 2019.

How will I receive the money?

If, for the last two years, you’ve received a tax refund by direct deposit, that is where the money will be sent.

If not, NBC News reports, “the IRS can mail a check to your ‘last known address,’ and it has 15 days to notify you of the method and amount of the payment. They’ll send a phone number and appropriate point of contact so you can tell them if you didn’t receive it.”

You are encouraged to notify the IRS as soon as possible if you have moved recently. It’s also suggested that if you have not filed for 2018 or 2019, you should do it as soon as possible, so that your information will be current on file.

Do I have to sign up?

No, there is no sign up.

Are there multiple payments?

No, this is only a one-time payment.

Will I get a check if I’m on Social Security or don’t make enough to file a tax return?

According to NBC News, yes, you will be eligible if you received a Form SSA-1099 for the year 2019, even if you didn’t file a tax return for 2018 or 2019 or pay taxes in those years.

Do I qualify if I am a disabled vet but don’t pay taxes?

Yes, but details are still being worked out. “The IRS is expected to set up a system so that disabled veterans don’t fall through the cracks,” NBC News reports.

Do I receive the money if I am a college student?

You are ineligible if you parents claim you as a dependent on their taxes. However, if you have been filing taxes independently and working in recent years, you might qualify.

I’ve now been laid off and made too much money in 2019 to qualify. What happens next?

You’re not necessarily out of luck, but you will need to wait.

According to NBC News, “if you made too much to qualify in your last tax filing, you probably won’t be eligible for the cash benefit immediately. But you can apply for it when you file your 2020 tax return if your income drops below below $99,000 threshold for individuals (which doubles for couples) this year.

The IRS is expected to create a system to ensure help for people who fall into this category.”

Do I qualify if I am not an American citizen?

Yes, you qualify as long as you are living and working in the U.S. with a valid Social Security number. That includes green card holders, and it generally includes those on work visas, such as an H-1B and H-2A.

Are the payments taxable?

No.

Do I have to pay the money back?

No, the government considers the money as a credit, and not a loan.

Is it a problem if I live in Puerto Rico or another U.S. territory?

No, NBC News reports that “there’s a special provision ensuring that people living in U.S. territories, even ones that have a different tax system, are still eligible.”

If I am homeless or am recently out of prison, will I still receive the help?

“As long as you have a Social Security number, you should be eligible to apply for the relief payments under the new system created by the IRS,” according to NBC News.

If I owe back taxes, do I still receive the payment?

Yes. Even if you owe past due taxes to federal or state government, your payment will not be affected.

What if I am behind on child support payments?

You are affected if you have past due child support payments. The IRS may reduce the amount you receive if your past due child support payments have been reported by states to the Treasury Department.

Associated Press and NBC News contributed to this article.